The Curator Economy: A Retail Revolution

Part II of IV

Content and commerce have been strange bedfellows since the 1500s, when businesses caught on to the idea that they could pay town criers to advertise for them as they made their rounds broadcasting the news. This is part II of a log of thoughts on the Curator Economy, driven by Super Creators who can commandeer a curated network of content, community, and conversation around them. This next part takes a deeper look at that intertwined relationship that's now supercharged by technology and behavioral leaps in streaming, shopping, and supply chains.

Content and commerce nestle together like peas in a pod. While advertising has been the dominant revenue model for most content publishing platforms, and by extension — for those Curators ("Super Creators") who receive revenue based on viewership or brand sponsorships, there are signs that Curators are moving towards monetization streams that tie directly into their brand and community.

The indirect monetization models leverage the power of the Curator's brand and community, but are loosely coupled in its incentives, with most or none of the ad revenue going towards Curators. We are seeing glimmers of an increasing shift towards direct, more symbiotic business models between curator and commerce, starting with a trend that points towards the long tail of retail: the Curator as storefront.

The Curator-as-Storefront

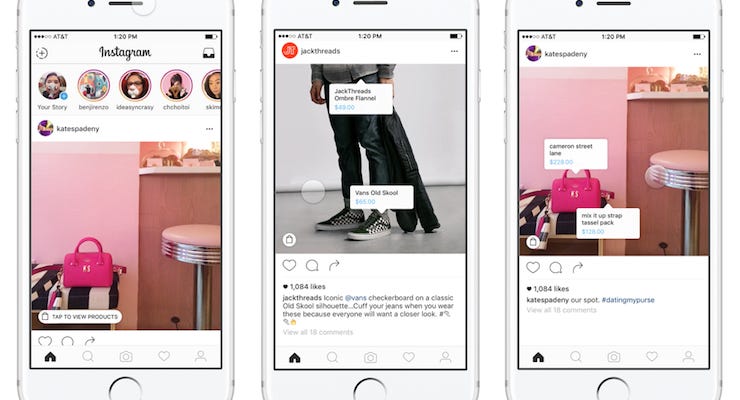

Most content publishing platforms today aren't designed to support commerce. Apart from brokered brand sponsorships, Curators have found workarounds like inserting affiliate links in a caption, or announcing giveaways and tagging brands in bosts. Instagram's Shopping feature gestures to a future state where content marries commerce, but currently (Aug 2020), listings are still limited to few retailers or approved brands.

Chinese social-commerce apps like Douyin (Tiktok in China) or Xiaohongshu are closer to what Curator-led retail experiences could be. Verified influencers are able to list or tag products sourced from wholesale sites like Taobao or JD.com, and followers can check out directly on the streamer's page. Douyin, which has about 300M daily active users, and grew over 200% in ecommerce purchases last year.

Today, Curators set up their ecommerce operation without leaving their living room. They could source inventory through wholesale sites (Faire, Taobao, JD.com), dropship products to a fulfilment service (Shipbob, ShipHero), set up a digital storefront and handle payments (Shopify, Stripe), and even outsource their marketing and creative needs by sending products to photography and video services (Soona, Squareshot). However, while these key infrastructure pieces for Curator-owned retail exists, it is still piecemeal and not integrated. Most crucially, Curators also need closer ties between their digital storefront and existing distribution and sales channels like Youtube, Instagram, or Tiktok.

There are opportunities to build:

An integrated stack for Curator-owned retail

Content-for-commerce social networks

Marketplaces for curators to source from brands

Ways for big-brand retailers to launch wholesale supplier marketplaces

... more (bounce ideas with me in the chat widget below!)

Beyond Storefronts: Curator-driven Retail Markets

Drops are red-hot. Limited-edition releases of rare sneakers "Jesus Shoes" by MSCHF to Dior x Nike Air Jordan 1s have quickly appeared at resale prices of 4x to 10x their original retail price moments after launch.

Boosted by a mix of fan fervor and fomo, these limited edition drops point to a fascinating trend in Curator-driven retail markets where early adopters snag coveted products for a lower price — in essence, rewarded if their bet on the trend was right. These objects are instantly elevated as collectibles, preserved in mint condition, and unlikely to be actually worn.

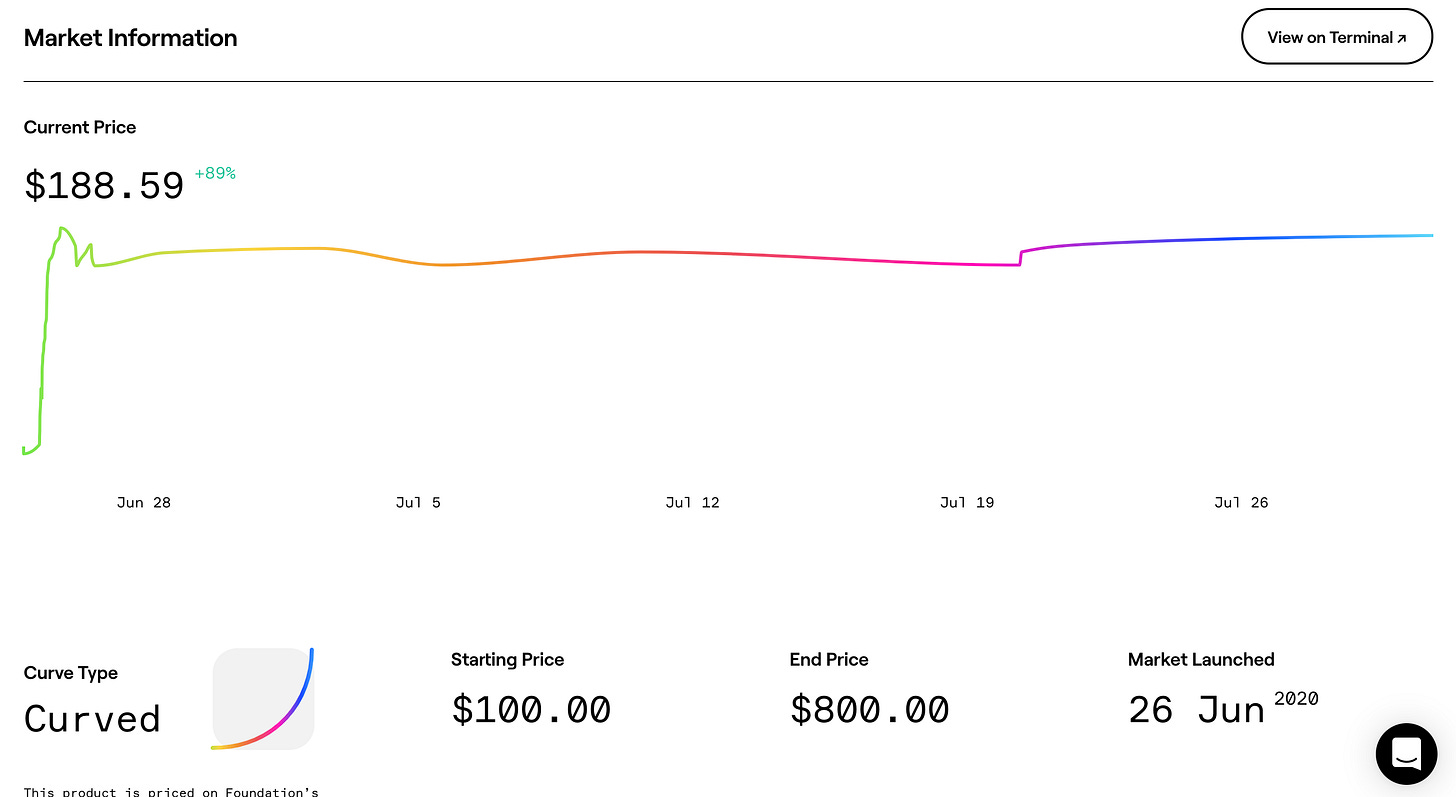

Startups like Foundation and Zora are building marketplaces that empower this rising trend of tradeble collectibles. Curators can drop a limited run of a collectible (for example, a cassette tape of RAC's new album), and have its price be dynamically determined by an algorithimic bonding curve with parameters like popularity and demand.

Rather than listing a rare sneaker you've snagged on StockX and mailing the sneakers over to the buyer, and so on, these retail markets enable much faster trades at dynamic prices, on a much more liquid exchange. In a conversation with IDEO co-investor Ian Lee, we talked about how these digital assets become almost like a synthetic for the physical product, some which may never end up being delivered.

A similar analog could be owning, and trading fractional shares in blue-chip art. Or imagine the possibilities: what if Kickstarter-backed products could be traded as digital assets before they were shipped? They could increase in value as the company gets closer to shipping, for example.

There is an exclusivity (both financial or social) with Curator economies, and we might see more experiments around membership-based access to curated goods (like Costco), where paying an annual fee gets you access to exclusive products. In the Curator Economy, this membership fee might be financial, or could be based on social capital, built up over measurable contributions like reputation or engagement.

The next part of the Curator Economy series dives into membership mechanics behind monetizing curated communities. It explores how Curators can reclaim ownership or create ways to scale the impact and value of the communities around them.