The $100K Question: What Happens When We Price Out the Next Generation of Builders?

This policy might reshape Silicon Valley completely.

$100,000.

That's the new entry fee for foreign talent to work in America. Not per year. One time. Per person.

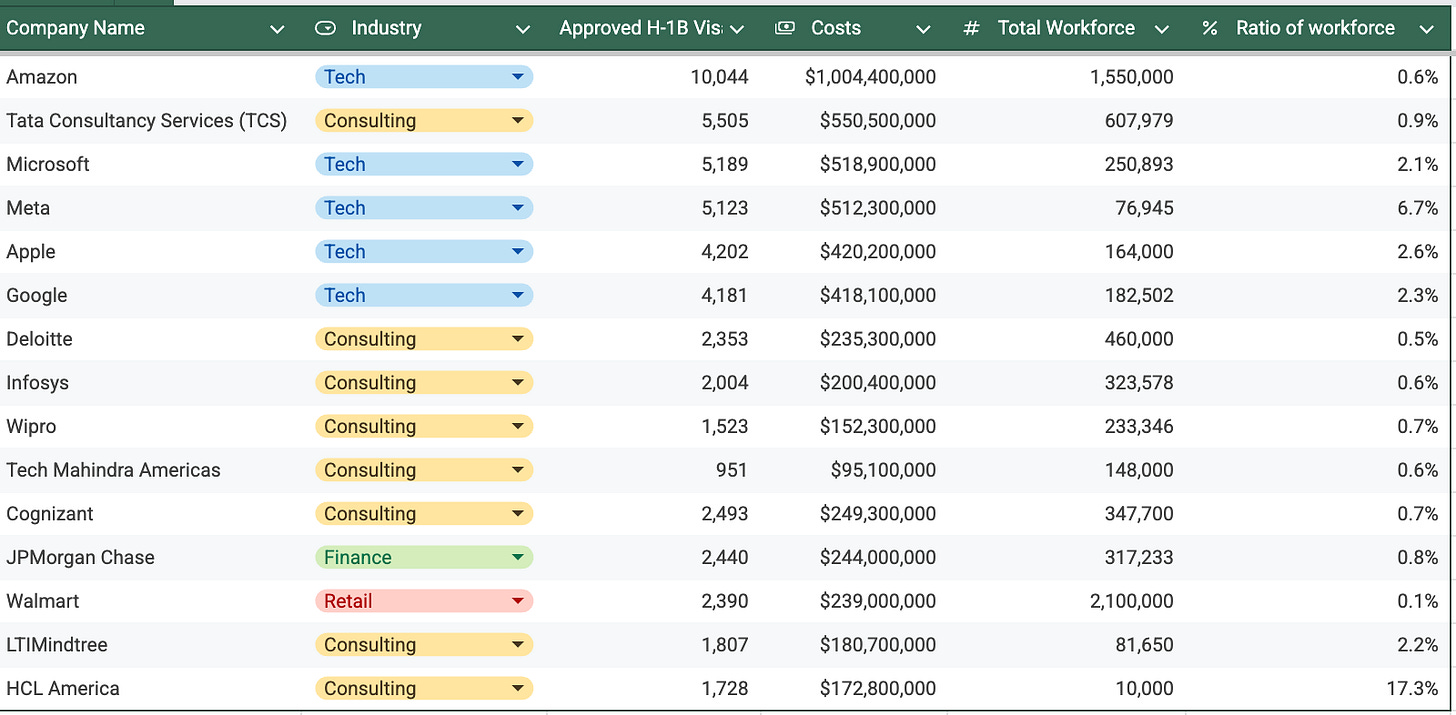

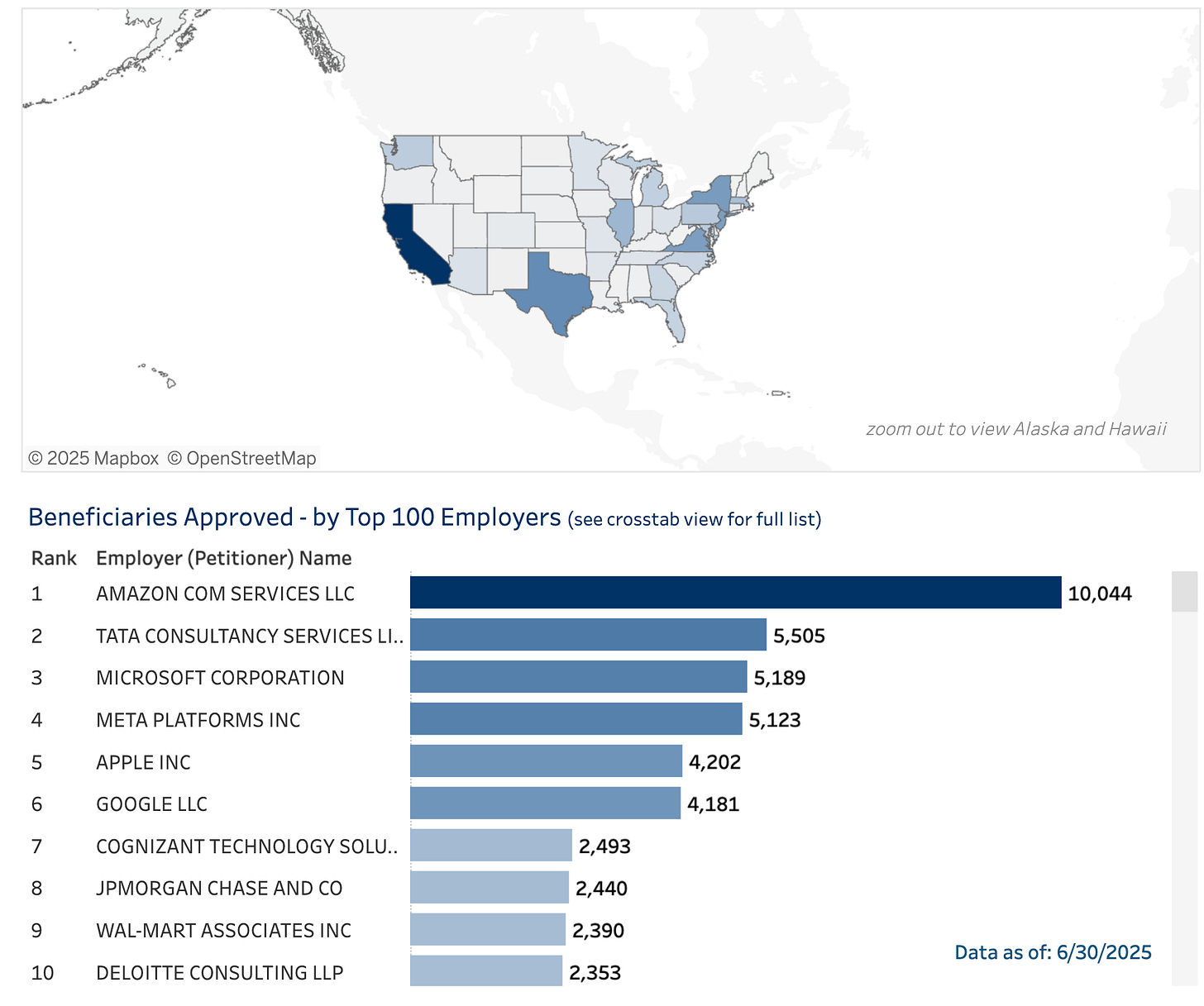

Let's be clear: there WAS a problem. IT consulting firms have been gaming H-1B visas for years. Based on the numbers I pulled from USCIS, HCL America runs 17% of their workforce on H-1Bs, compared to the fractional or single digit % at most tech companies.

A $100,000 fee kills that model dead. Good.

But here's where policy meets unintended consequences.

The same fee that stops consulting firms from gaming the system also prices out the 23-year-old who might build the next AI breakthrough. The big tech firms who actually do rely on exceptional international tech talent will face $500M in additional HR costs. Amazon faces over $1 billion in potential costs.

This might reshape Silicon Valley completely.

The New Normal: Distributed by Default

For fifty years, ambitious technical talent globally had one destination: Silicon Valley. Not for the weather or culture - for the other builders. The density created magic. You couldn't throw a stone without hitting someone working on something impossible.

The $100k fee doesn't stop big tech from hiring. Google and Meta will pay it. But startups won't. Series A companies won't. The weird experimental labs won't.

Why pay an additional $100k just to bring someone to San Francisco when you can hire them in Toronto?

We're already seeing it. AI labs opening in Singapore. Engineering teams in Warsaw. Research pods in Tel Aviv. Not as satellites, but as core operations, with HQ in the United States to access capital markets and customers. The pandemic proved remote works. This policy might make it mandatory.

While the U.S. still gets capital gravity (financial markets, exits, etc), the intellectual center of gravity (the weird ideas, the late-night hacking, the "what if we tried this" conversations) disperses.

We might lose what made it special. The density of builders in one place, randomly colliding, starting things.

The Founders Who Never Happen

55% of America's billion-dollar startups have immigrant founders. But most of them didn't arrive as founders.

You can't actually start a company on an H-1B. The actual path looks like this: Student visa → H-1B job → build networks → get green card → start company.

They became founders or tech leaders after years of working here, meeting co-founders at hackathons, understanding what Americans would buy, building credibility with VCs.

Satya Nadella worked at Sun Microsystems before Microsoft. Sundar Pichai was at McKinsey. Musical.ly (what became Tiktok’s iconic scroll) cofounder Alex Zhu was a PM and designer at SAP and WebEx.

We solved the consulting arbitrage problem with a sledgehammer when we needed a scalpel.

The magic of Silicon Valley wasn't importing proven talent. It was attracting unproven talent and giving them room to become exceptional. This is what’s made it different from every other innovation economy in the world.

At $100k per bet, those chances don't get taken. Those builders go elsewhere. And the gravitational pull that made Silicon Valley inevitable becomes resistible.

We'll keep the venture capital. The IPO market. The fancy headquarters.

But the garages where magic happens will be somewhere else.

The Download

OpenAI might be developing a smart speaker, glasses, voice recorder, and a pin: One of the mysterious AI devices that OpenAI is considering developing with Apple’s former chief design officer, Jony Ive, “resembles a smart speaker without a display,” The Information reports.

Nvidia to invest $5B in Intel as part of new chip partnership: Nvidia announced plans to invest $5 billion in Intel Corp. as part of a collaboration that will see the companies jointly develop new chips. The partnership encompasses both the data center and consumer segments. Nvidia plans to incorporate the custom chips that Intel will develop as part of the partnership into its “AI infrastructure platforms.”

Gemini tops the App Store thanks to new AI image model, Nano Banana: The app has climbed to the top of global app stores’ charts and has seen a 45% month-over-month increase in downloads in the month of September so far, according to new data provided by app intelligence firm Appfigures. The app’s rapid growth is also driving increases in consumer spending. Of the $6.3 million Gemini generated this year on iOS devices, $1.6 million was from the month of August, with much of that coming in after the Nano Banana model’s release. That’s up 1,291% from January’s figure of $115,000.