Is AI reversing a decade of software sprawl?

Enterprises and individuals are consolidating software at a rapid pace. What happens to the unicorns left holding 2021 valuations?

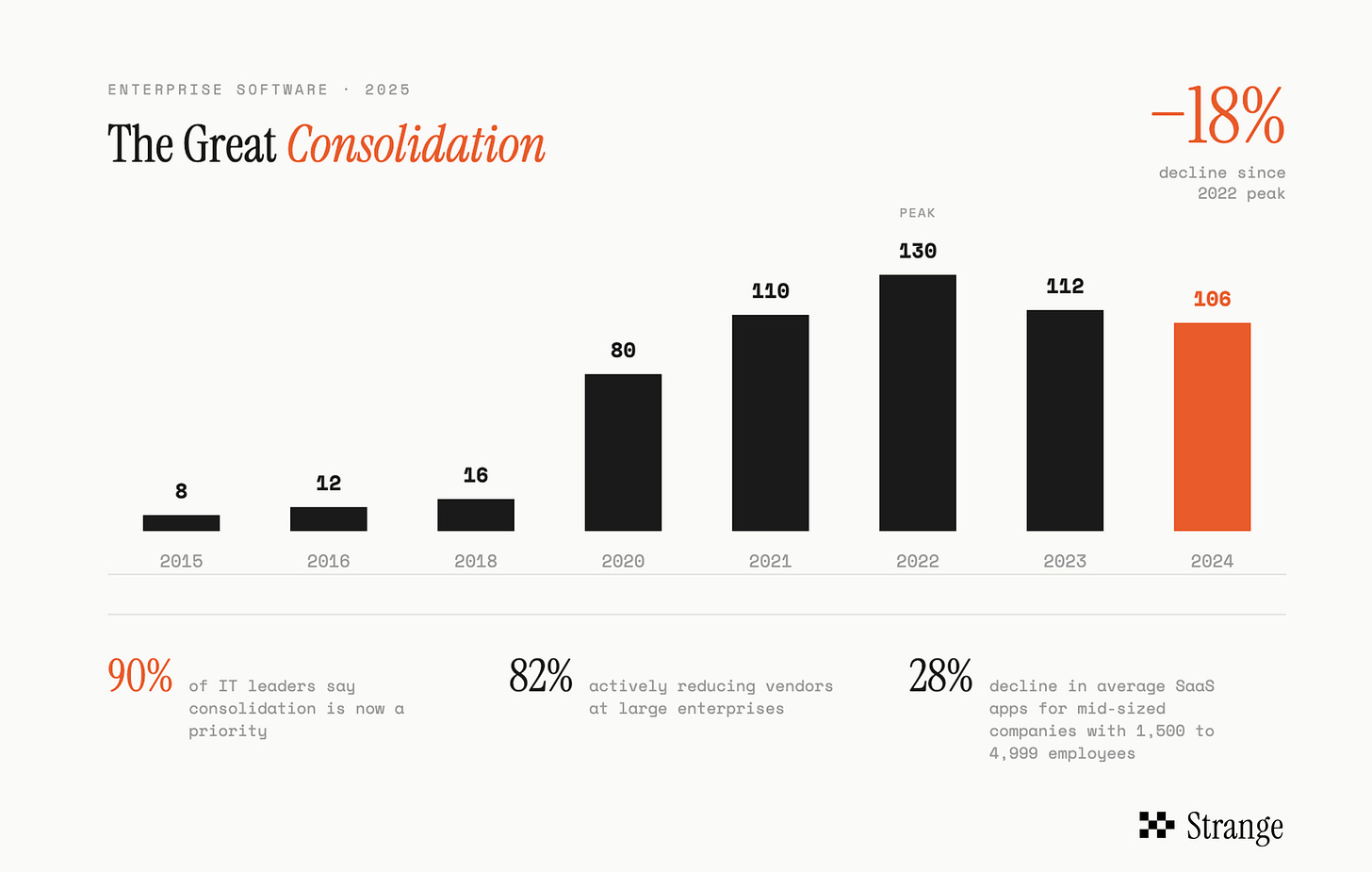

I’ve cancelled more software subscriptions this past year than ever before. Same story in my group chats. This feels like a canary in a coal mine: according to this BetterCloud report, 90% of enterprises now say software consolidation is a priority.

It makes sense. Why piece together hundreds of software subscriptions when AI can help pull from a unified database and build custom apps and workflows that fits you and your own?

This is a massive market to disrupt. Enterprises in the US spend over $8,700 annually per employee, with a staggering 51% of licenses that goes unused.

We’re starting to see the first decline of SaaS subscriptions in a decade, with an average of 18% decline for enterprises, and 28% decline for mid-sized businesses.

As a venture investor, the question I keep coming back to: what happens to the massive valuations handed out during SaaS’s heyday?

The “unicorn backlog” estimates 412 enterprise startups valued at over $1b that are still private, and haven’t raised any capital in 18 months. Around half of the $5B+ unicorns (106 of them) carry peak market valuations from 2021 and 2022.