The Rare Earths Monopoly

GTC in Washington marks the moment Silicon Valley realized you can't build empires on someone else's foundation.

Nvidia held its GTC conference in Washington DC today. A first for the company.

CEO Jensen Huang stood on stage and announced collaborations with the Department of Energy to build AI supercomputers at Argonne and Los Alamos National Labs. One system, “Solstice,” will have 100,000 Blackwell GPUs. Another, “Equinox,” gets 10,000. They introduced “AI Factory for Government,” a full-stack reference design for federal agencies. They deepened partnerships with Supermicro for U.S.-based manufacturing of government-optimized systems. They announced “NVQLink,” a hybrid computing architecture combining classical GPUs with quantum components.

The entire presentation was wrapped in pro-American manufacturing rhetoric. Nvidia didn’t come to DC to sell chips. They came to signal that the era of tech companies operating independently from government is over.

Here’s why: America’s technology advantage is stacked wrong. We dominate the top - chip design, AI models, software platforms, IP. We’re unmatched at the abstraction layers. But the physical substrate beneath it? Outsourced. Offshored. Dependent.

The computing stack:

Top (Where U.S. strengths lie):

Chip architecture (Nvidia, AMD, Apple)

AI models (OpenAI, Anthropic, Google)

Cloud platforms (AWS, Azure, Google Cloud)

Software and applications

Bottom (foreign dependency):

Advanced semiconductor manufacturing (TSMC/Taiwan, Samsung/Korea)

Rare earth processing (China: 87%)

Legacy chip production (increasingly China)

Battery manufacturing (China: 76%)

Critical materials (heavily concentrated in China)

If China controls the bottom and neutralizes the top with domestic chip production, AI development, and export controls on materials, American dominance evaporates.

Nvidia understands this. So does the Pentagon. So does the Department of Energy. GTC in Washington was tech and government acknowledging they need each other to solve a problem neither can solve alone.

The Infrastructure We Abandoned

The deeper issue is infrastructure abandonment across the board.

Over 40 years, we offshored physical production in favor of “knowledge work.” The implicit bet: let others make things, we’ll design them and capture value through IP. Software and platforms have higher margins than manufacturing anyway.

This worked brilliantly. Then it didn’t.

What we lost in

Manufacturing capacity:

Shipbuilding: 0.2% of global capacity (from 70% in the 1950s)

Steel: 4% of global production (from 25% in the 1970s)

Consumer electronics: Essentially zero domestic production

Solar panels: China controls 80%+

Advanced batteries: China 76%

Critical materials processing:

Rare earths: China 87-90%

Pharmaceutical precursors: 90% from China/India

Gallium: China 98%

Germanium: China 67%

Offshoring manufacturing for four decades doesn’t just mean we lose factories. We also lose the ecosystem and talent: suppliers, skilled workers, equipment manufacturers, engineering programs, apprenticeship pipelines. The knowledge doesn’t return because you want it to. The professors retired. Workers retrained. Their children chose other fields.

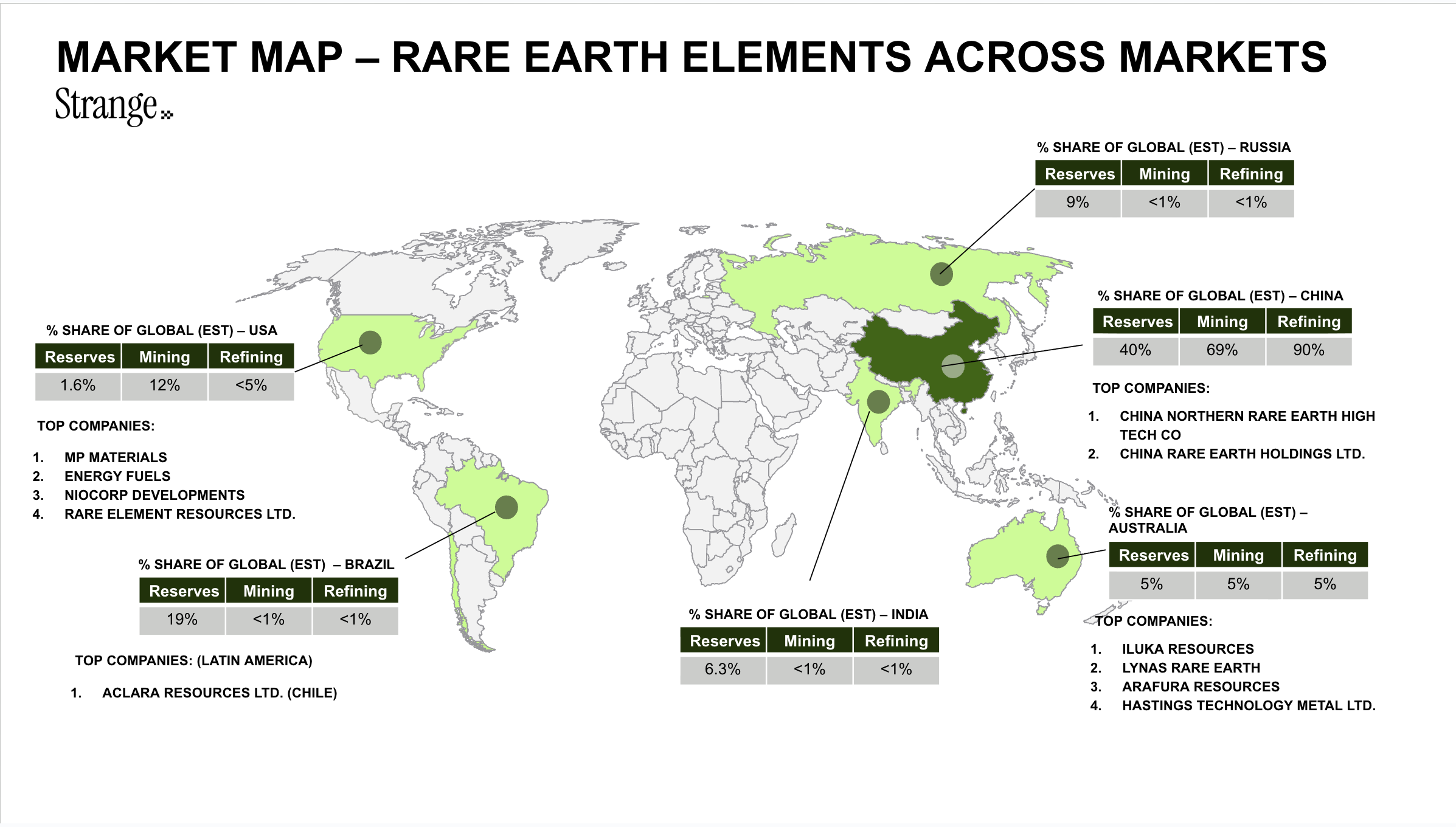

Rare Earths: How to Build a Monopoly in 30 Years

“The Middle East has oil, China has rare earths.”

Deng Xiaoping, 1992

Starting in the 1990s, China embarked on a 30-year strategy that built an unbreakable monopoly around rare earth elements.

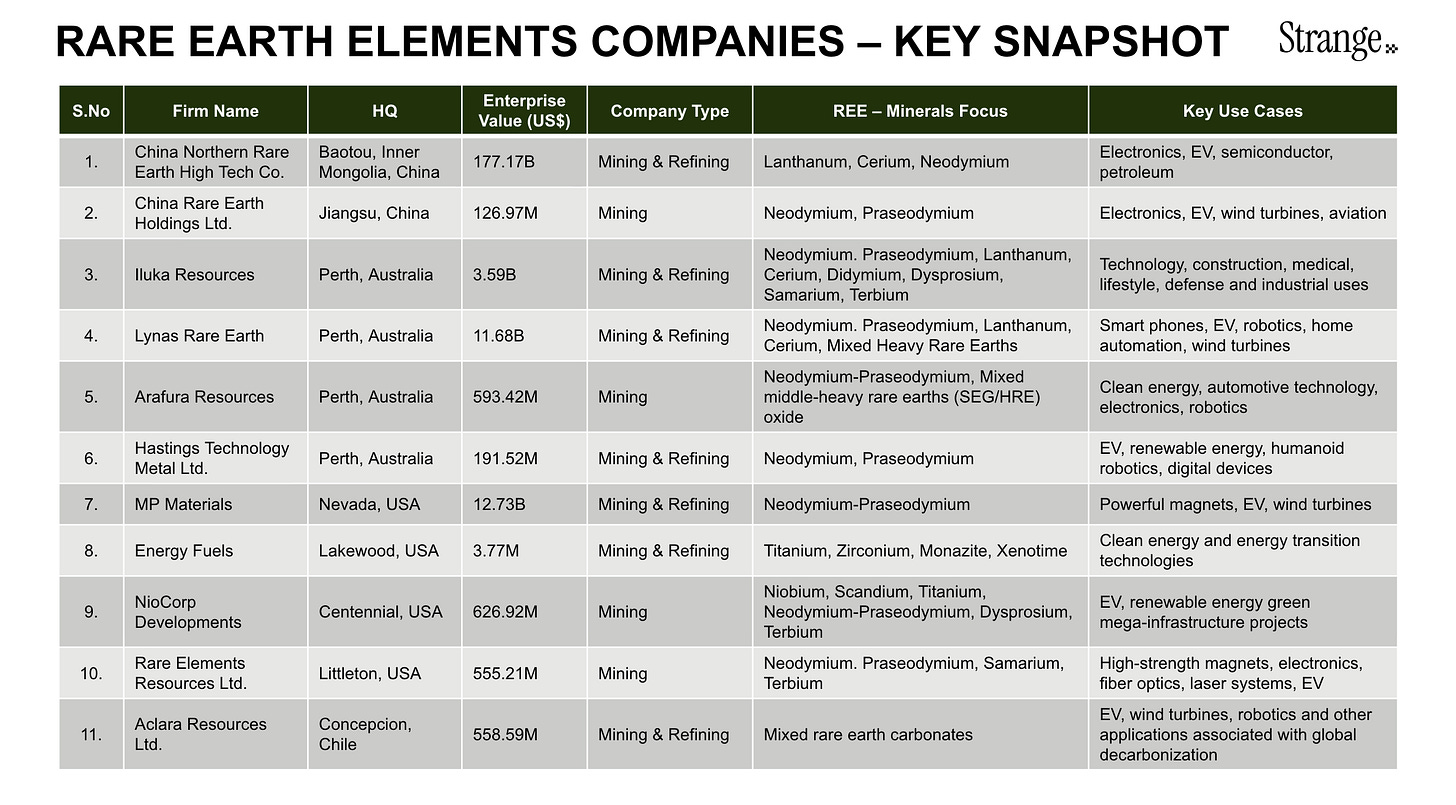

Rare earths are 17 elements that enable high-performance magnets. Magnets that power every EV motor, every F-35 fighter jet (417kg each), every wind turbine, and the lithography equipment that makes advanced semiconductors. Contrary to the name, these elements are not actually rare, and can be found globally, but processing them post-mining is environmentally toxic and complex.

The U.S. were actually the inventors of the processing technology. But then environmental costs became visible: wastewater spills, lawsuits, EPA compliance. So we outsourced this to other countries.

And China took on the work. Minimal regulation. Toxic waste lakes visible from satellites. Villages downwind with cancer rates 7x the national average.

China accepted the environmental sacrifice America wouldn’t.

Then the government went all in on the strategy: Sold rare earths below cost for a decade, eliminating competition. After competitors closed, China consolidated the industry under state control.

Today:

China: 240,000 tons/year processing, 87% global share, 94% of magnet manufacturing

Rest of world: 40,000 tons/year

United States: One magnet manufacturer

This is what coordinated government-industrial strategy looks like over three decades.

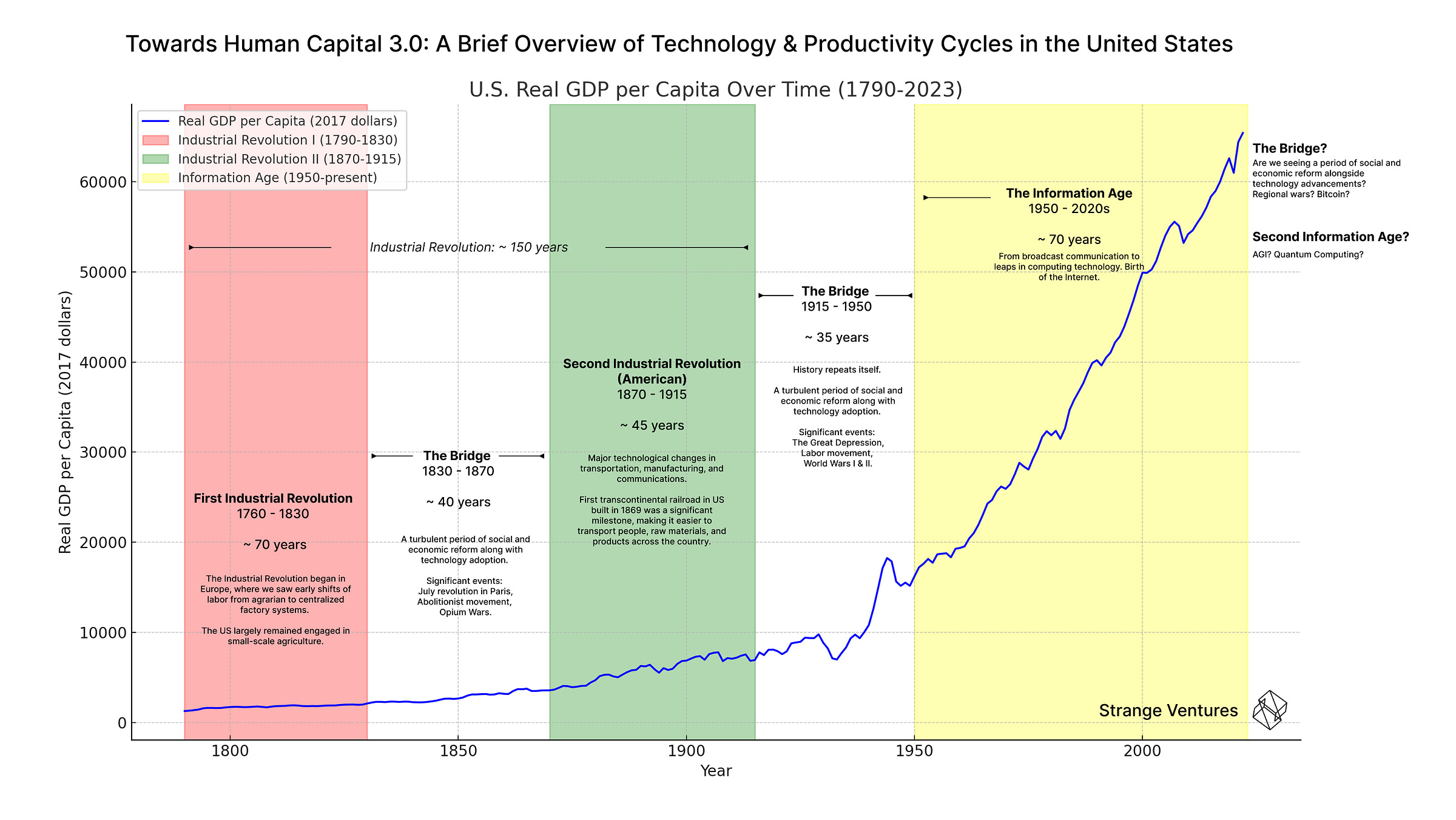

The Post-WWII Parallel: Can America continue its bull run?

America’s post-WWII economic boom was born from partnership between government and industry. Government coordinated, subsidized, and de-risked long-term infrastructure investments.

In the 1940s-1970s:

Interstate Highway System (1956-1992): $129 billion in 1991 dollars, roughly $500 billion today. Transformed logistics, enabled economic connectivity. Government-led.

Rural Electrification Act (1936): Brought power to farms and towns. By 1950, 90% of U.S. farms had electricity versus 10% in 1930.

Telecommunications: Government funding for Bell Labs research produced transistors, lasers, Unix, C programming language. Foundations of the information age.

Space Race / DARPA: Government investment produced satellites, GPS, the internet (ARPANET), modern computing architecture.

Starting in the 1980s, we took on different ideology.

Let globalization and free markets handle infrastructure. Focus on IP and knowledge work. Outsource physical production to whoever does it cheapest.

The belief:

“Government shouldn’t pick winners”

“Markets are more efficient than industrial policy”

“Comparative advantage: we do IP, others manufacture”

“Capital flows to highest returns, not strategic necessity”

Result: 40 years of infrastructure underinvestment.

While America worshipped free markets, China executed state-directed infrastructure buildout.

GTC in Washington signals the cultural break is real.

Recent industrial policy in the last 5 years:

CHIPS Act (2022): $52 billion for semiconductor manufacturing. Subsidies, tax credits, guaranteed purchases.

Inflation Reduction Act (2022): $369 billion for clean energy. Subsidies for solar, wind, batteries, EVs, tied to domestic and allied supply chains.

Infrastructure Investment and Jobs Act (2021): $1.2 trillion for roads, bridges, broadband, electric grid.

Defense Production Act: Invoked to guarantee purchases of rare earths, batteries, critical materials.

This is the most aggressive U.S. industrial policy since the 1950s-60s. And in some cases, the government becomes an investor.

MP Materials, a rare earth mining company, was losing $23 million quarterly. In 2020, DoD took a 15% stake and guaranteed floor prices: $110/kg for neodymium-praseodymium when market price was $30/pound.

Intel: The U.S. government now owns 9.9% of Intel after an $8.9 billion investment to secure domestic semiconductor production.

This is the new normal. Expect more government stakes in strategic tech companies over the next decade. Defense, semiconductors, batteries, critical materials. The line between private sector and national security is disappearing.

How We Can Move Faster

Rebuilding physical infrastructure takes decades. America still has advantages: people want to immigrate here, and we’re still the largest capital market.

To accelerate:

1. Aggressive Immigration for Technical Talent

America’s technological advantages have always come from importing expertise. The Manhattan Project imported European physicists: Einstein, Fermi, Teller. Built the atomic bomb in three years. Operation Paperclip brought 1,600 German scientists after WWII. Wernher von Braun’s team put America on the moon.

Maybe we create a “Strategic Supply Chain Visa” category:

Target: Process engineers, metallurgists, semiconductor specialists, battery scientists

Fast-track citizenship: 2-3 years versus current 10-15

Without this, we’re building facilities we can’t operate efficiently. You can construct a rare earth separation plant with money. You can’t easily rebuild the decades of tacit knowledge required to run it.

2. Allied Partnerships

We can’t rebuild everything domestically overnight. We need to build diversified, resilient supply chains across allied nations.

With global partners:

Coordinate mining and processing technology development

Share R&D on rare earth alternatives and recycling

U.S. provides guaranteed demand via defense procurement

Joint strategic reserves for critical materials

3. Leverage Software Dominance

The world runs on American software: Microsoft, Google, Apple, AWS, Meta. This gives leverage.

U.S. software platforms remain China’s largest market outside domestic operations. As long as global companies want access to American software ecosystems and cloud services, we maintain negotiating power on the physical layer.

Concentrate demand for the IP and products. This keeps America as China’s biggest software buyer while reducing our hardware vulnerability.

What This Means

Get used to government hands in private tech. The next decade will bring more equity stakes, more guaranteed purchases, more industrial policy. The distinction between “commercial tech company” and “strategic national asset” is blurring.

Semiconductors, rare earths, batteries, advanced materials, AI infrastructure. Any company operating in these sectors should expect government involvement: funding with strings attached, supply chain mandates, foreign investment restrictions, and in some cases, direct equity stakes.

GTC in Washington is Silicon Valley acknowledging that innovation without infrastructure is temporary advantage.

The post-WWII boom wasn’t only American ingenuity. It was having unmatched physical capacity to execute. Government invested in highways, power, telecommunications, aerospace. Private innovation flourished on that foundation.

We spent four decades believing we’d transcended that. Software doesn’t need factories. IP doesn’t need supply chains. Knowledge work is more valuable than physical production.

Then China demonstrated otherwise. You can’t run AI without semiconductors. Can’t make semiconductors without rare earth equipment. Can’t build EVs without batteries and magnets. Can’t project military power without rare earth-dependent weapons.

Every American boom cycle required massive infrastructure investment. The post-war acceleration wasn’t magic. It was highways, power grids, and telecommunications. The next acceleration requires chips, batteries, and rare earths.

Whether America continues its bull run will depend on whether we can build that.

Thank you Tara for such an extraordinarily well researched and beautifully written article. Apart from being immensely jealous of your ability I also wondered if you think the US has the capacity to plan long term like China, which is renowned for thinking decades ahead instead of being locked into 4-year cycles?